Understanding Gold IRA Companies: A Comprehensive Information

페이지 정보

작성자 Josephine 작성일25-07-16 22:18 조회41회 댓글0건본문

In recent years, the allure of gold as a protected-haven asset has gained important traction among buyers looking for to diversify their portfolios and protect their wealth from financial uncertainties. One in all the preferred strategies for investing in gold is thru a Gold Individual Retirement Account (IRA). This article goals to provide a comprehensive understanding of Gold IRA companies, how they function, the benefits they offer, and concerns for choosing the proper provider.

What's a Gold IRA?

A Gold IRA is a type of self-directed Individual Retirement Account that enables buyers to carry physical gold and other precious metals as a part of their retirement portfolio. In contrast to traditional IRAs that usually hold stocks, bonds, and mutual funds, a Gold IRA gives the unique opportunity to spend money on tangible assets like gold bullion, coins, silver, platinum, and palladium. This can be a strategic move for these looking to hedge towards inflation and economic downturns.

The Position of Gold IRA Companies

Gold IRA companies specialise in facilitating the establishment and administration of Gold IRAs. They help buyers in purchasing valuable metals, establishing the IRA, and ensuring compliance with IRS regulations. These corporations sometimes offer a range of companies, together with:

- Account Setup: Gold IRA companies guide traders by means of the means of organising a self-directed IRA, which allows for the inclusion of bodily treasured metals.

- Custodianship: For the reason that IRS requires that all IRAs have a custodian, Gold IRA companies accomplice with accepted custodians who hold the physical gold on behalf of the investor.

- Metallic Selection: These companies present expertise in choosing the precise kinds of gold and other precious metals to put money into, ensuring they meet IRS standards for inclusion in an IRA.

- Storage Solutions: Gold IRA companies usually provide safe storage options by way of third-social gathering vaults, ensuring the security of the bodily property.

- Liquidation Companies: When it's time to promote or liquidate the property, Gold IRA companies can assist in the process, serving to traders navigate the market.

Benefits of Investing in a Gold IRA

Investing in a Gold IRA comes with several advantages:

- Diversification: Gold serves as a hedge against market volatility and financial downturns. Together with gold in a retirement portfolio might help steadiness dangers associated with conventional investments.

- Inflation Hedge: Historically, gold has maintained its worth throughout inflationary durations. Because the buying power of fiat currencies declines, gold often appreciates, making it a dependable retailer of worth.

- Tax Advantages: Gold IRAs offer the identical tax advantages as traditional IRAs. Investors can defer taxes on positive factors till they withdraw funds throughout retirement, allowing for potential progress with out quick tax implications.

- Tangible Asset: In contrast to stocks or bonds, gold is a physical asset that may provide a way of security. Traders can hold and retailer their gold, giving them peace of mind in unsure occasions.

- Protection In opposition to Currency Devaluation: In times of financial instability or geopolitical tensions, gold usually retains its worth, serving as a safeguard towards forex fluctuations.

Choosing the proper Gold IRA Company

Deciding on the fitting Gold IRA company is crucial for a successful funding expertise. Listed here are some factors to consider when evaluating potential suppliers:

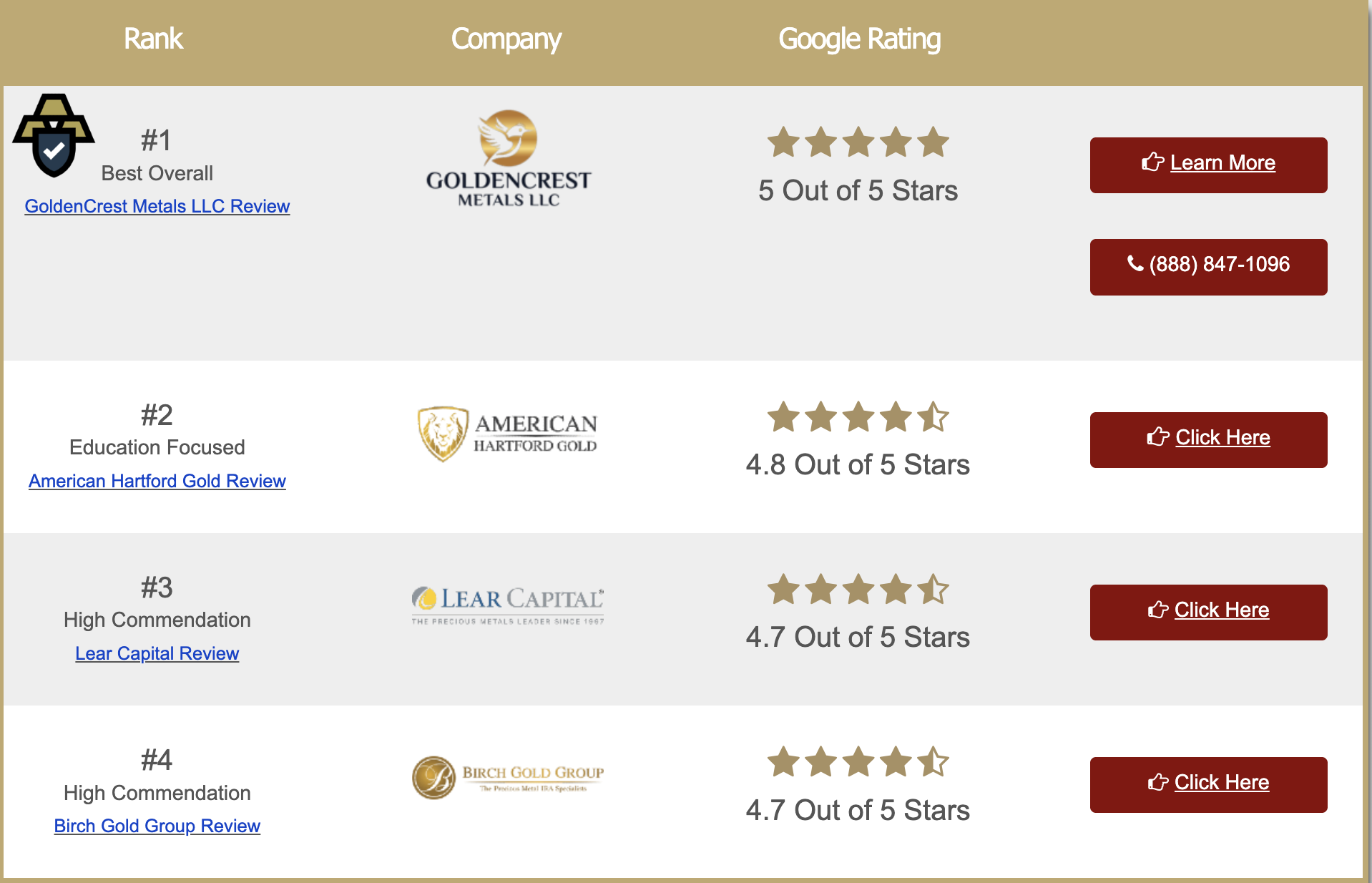

- Status and Credibility: Research the company's monitor report, customer opinions, and business status. Look for companies with optimistic feedback and a history of happy clients.

- Charges and Prices: Perceive the payment structure associated with the Gold IRA. Common charges include account setup charges, irasgold annual maintenance fees, storage fees, and transaction fees. Compare totally different providers to find one that provides aggressive pricing.

- Educational Assets: A good Gold IRA company ought to offer academic supplies and sources to assist traders make informed selections. Look for corporations that provide guidance on market tendencies and investment methods.

- Customer service: Evaluate the level of buyer help offered by the corporate. A responsive and knowledgeable customer service crew can considerably enhance the investment experience.

- Storage Options: Inquire in regards to the storage options obtainable. Be certain that the corporate companions with safe, IRS-authorised facilities for storing treasured metals.

- Transparency: A trustworthy Gold IRA company can be clear about its operations, fees, and policies. Keep away from corporations which might be vague or unwilling to provide detailed data.

Widespread Misconceptions About Gold IRAs

Despite the benefits, there are several misconceptions about Gold IRAs that potential buyers ought to be aware of:

- Gold IRAs Are Just for Wealthy Traders: Whereas gold could be a considerable investment, individuals of all monetary backgrounds can benefit from a Gold IRA. Many firms offer flexible investment options and decrease minimums.

- Gold IRAs Are Complicated: While there are regulatory requirements to observe, reputable Gold IRA companies present guidance all through the method, making it accessible for buyers.

- Gold Is Always a Secure Funding: Whereas gold can be a hedge towards market volatility, it is not immune to price fluctuations. Buyers should conduct thorough analysis and consider their danger tolerance earlier than investing.

Conclusion

Gold IRA companies play a significant role in serving to buyers navigate the complexities of investing in gold and different treasured metals for retirement. With the potential for diversification, inflation safety, and tax benefits, Gold IRAs could be a helpful addition to a retirement portfolio. Nonetheless, choosing the proper Gold IRA company is crucial for maximizing these benefits. By conducting thorough analysis, evaluating providers primarily based on reputation, fees, and customer support, and understanding the realities of gold investing, individuals could make knowledgeable selections that align with their monetary targets. As with any funding, it is essential to stay informed and consider consulting with a monetary advisor to ensure that a Gold IRA is appropriate in your distinctive scenario.

댓글목록

등록된 댓글이 없습니다.